The Millennial “When I Was Your Age” Story

Millennials have been told stories prefaced with “back in the day” or “when I was your age” for most of their lives and I, like many 30 somethings, appreciate the growth and change that our society has experienced between generations. After all, most millennials have not experienced walking several miles to school, in the snow, uphill, both ways (see graphic below for visual representation of this daily commute in the pursuit of education).

Knowing that each generation boasts hardships that they endured and overcame, I am confident that millennials will also have their own “back in the day”/ “when I was your age” stories to tell one day.

These are just a few of the stories that we will have in our repertoire:

When I was your age, higher education felt like a requirement that left us in a ton of debt.

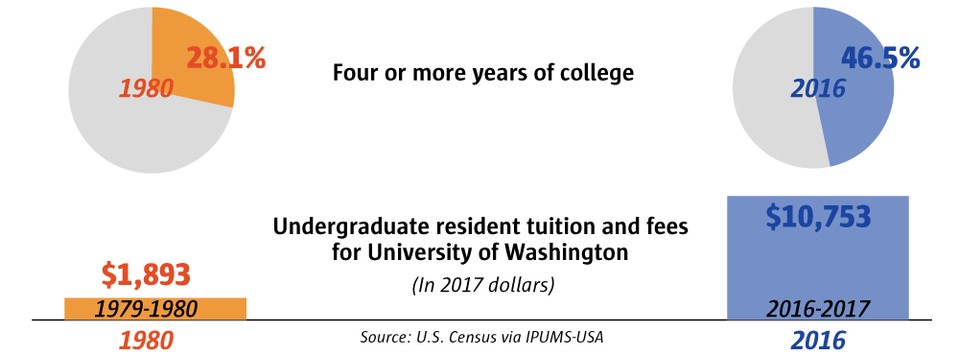

As the importance (and expectation) of higher education has increased, so has the amount of debt that young adults have upon entering the real world. The graph below from The Seattle Times shows that the percentage of 25 to 30-year-olds who have attended college for four or more years has increased dramatically, as has the debt that accompanies higher education. This ultimately leads to the need for higher paying entry level jobs so that recent college grads can start whittling down their debt immediately after they complete their education. Not only does this create more competition among candidates for higher paying jobs, but it also means that employers may need to offer higher wages to attract college educated employees.

Back in the day, the unemployment rate was so low that everyone had a job.

Although it isn’t true that everyone has a job, with the unemployment rate in Seattle currently at 3.7% (Bureau of Labor Statistics), it can feel that way sometimes. And what would a good “back in the day” tale be without some slight exaggeration? While applicants are encountering less competition for open positions, employers may be struggling to find quality candidates who are not already happily employed.

When I was your age, saving for retirement wasn’t a realistic option.

According to the National Institute on Retirement Security, 66% of people between the ages of 21-32 have nothing saved for retirement. Why? A large part of the lack of retirement saving can be attributed to the rise in student debt and the cost of housing. Unfortunately for many workers, it is simply not realistic to pay off a mountain of student debt and the high price of a home while saving for their retirement. The immediate needs are pushing planning for the future farther down the list of priorities; as a result, chances are that retirement will be delayed for our generation. This also makes jobs that offer retirement plans, such as a 401(k), even more desirable to job seekers.

Back in the day, I couldn’t afford to buy a house.

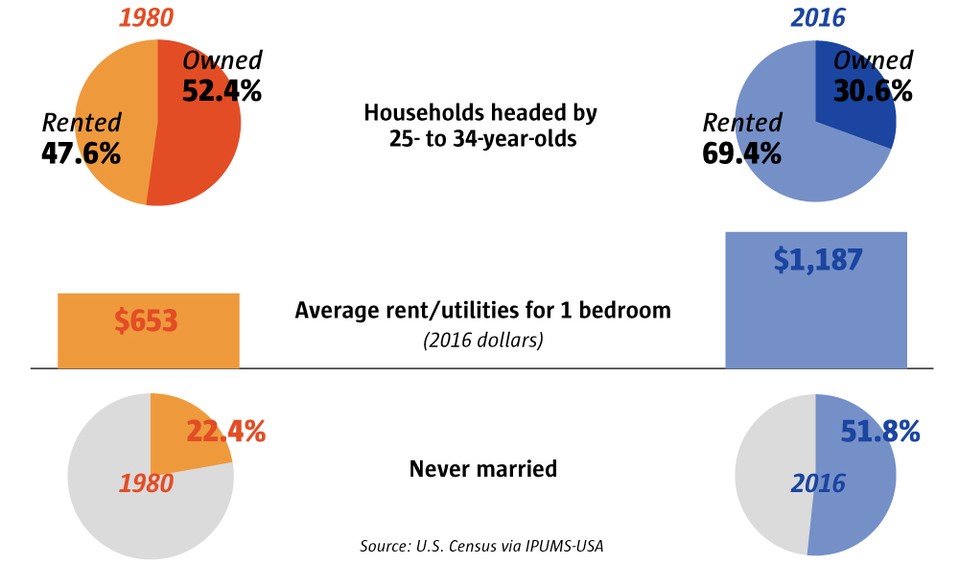

According to the graphic below from The Seattle Times, young adults are favoring renting rather than buying houses. The high cost of housing often prevents millennials from purchasing until they are more established in their careers.

Like generations before us, these “when I was your age” stories will one day show our resilience through difficult circumstances.