Tax Return: Excuse to Splurge or Opportunity to Save?

Tax season is upon us, and depending on your tax liability you may be looking forward to a hefty refund. If you overpaid in taxes last year, the extra money that was taken out of your paychecks throughout 2016 will be returned to you by the government a few weeks after you file your income tax return. If you do receive a refund, that essentially means that last year you loaned the government money (interest free) that they are now paying back. With the average income tax return in 2016 coming out to a whopping $2,860, and Tax Day (April 18th) creeping up on us, make sure that you plan ahead and consider the following options for your return.

Option #1: Pay Off Debt

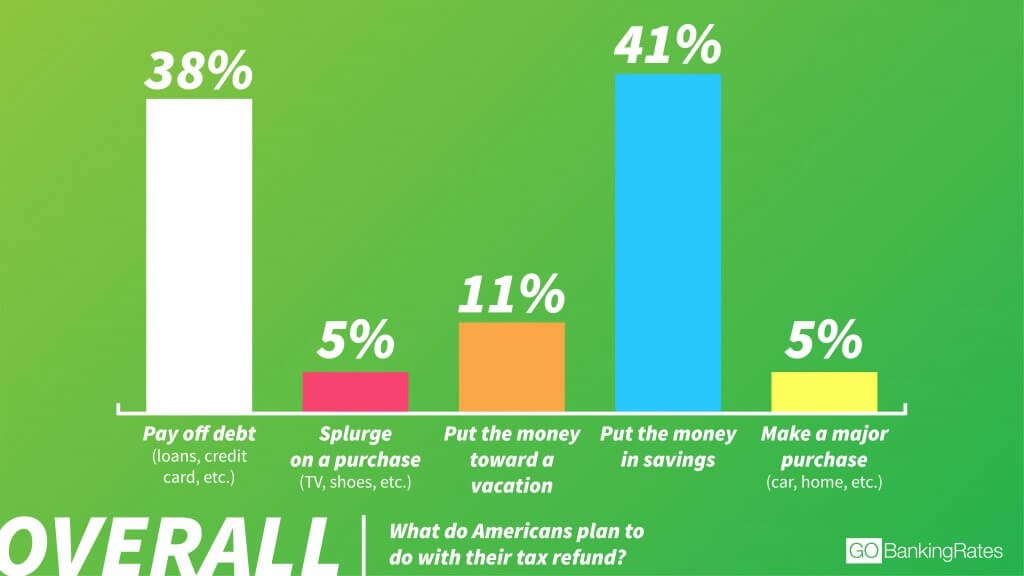

Before you start shopping for a new gadget to spend your tax return on, it may be wise to take a look at your credit cards and other debt. There’s a reason that 38% of Americans who are expecting a tax refund are planning on using it to tackle their debt. That reason? Interest. If you have borrowed money from an institution or have credit cards, chances are that that money is accruing interest. By using your refund to pay off some of your debt, you are avoiding paying more interest than you need to in the long run.

Option #2: Save

Let’s say that you have a little money left over from your refund after you have paid off your credit cards (or you are lucky and are already debt free), is it fiscally responsible to go ahead and treat yourself to an unnecessary new electronic device? Short answer, no. A better financial decision is to take that extra money and start saving for those pesky emergency situations such as car repairs or unplanned medical expenses. If you choose this option, you won’t be alone. In fact, according to GOBankingRates 41% of the population that is expecting a tax return is planning on building up their financial security by adding their refund to their savings account.

Option #3: Major Purchase

Along with paying off debt and building a nest egg, another way that Americans are planning on spending their tax return is making a major purchase. Although the first two options are better known for being financially sound choices, using a tax refund for a major purchase is also a smart choice for your wallet. This is a smart choice since large purchases often end up on your credit card or involve taking out a loan, both of which result in interest payments. If you find yourself needing to make a major purchase in the near future such as buying a house, making renovations, or buying a new car, consider using your tax return to fund a portion of it. Even though only 5% of people anticipating a tax refund are planning on using it towards a major purchase, this option should not be overlooked as a financially responsible choice.

Option #4: Splurge

Maybe you are one of the rare people receiving a refund this year that doesn’t have debt and is comfortable with the amount of money in their savings account, or you aren’t interested in using your return to get ahead financially and want to have some fun with it. In that case, you would have something in common with the 5% of Americans that GOBankingRates surveyed who said that they wanted to use their tax return to splurge. If you save and stay debt free throughout the year, this may be the perfect time to treat yourself to a new TV, or even put the money towards a vacation like 11% of those surveyed are planning on doing this year.

No matter what you choose to do with your refund, it is important to consider all of your options and make the choice that will benefit you the most.